I'm starting a new 90-day course! This time about finance; Since during these last few months I am realizing the importance of understanding how money, and the economy in general, works. So here we go with Finance for Everyone: Smart Tools for Decision-Making, by finance doctor Gautam Kaul.

First of all, I want to make a brief review of the teacher in charge of teaching this course, Gautam Kaul, since I find the enthusiasm with which he explains each and every one of the concepts fascinating, and the closeness that he is able to transmit despite be recorded on a delayed basis. I was truly surprised by the sparkle in his eyes, and the warmth of his speech despite speaking to a camera hehe.

Post content:

Finance for everyone: The most basic concepts of the course

Although the professor's enthusiasm for explaining the entire world of finance is undeniable, there is something that I would like to make a brief point about, and that is: his eagerness to use Excel to solve almost 100% of the problems.

On the one hand, I understand that anyone who dedicates themselves to finance today will do so with Excel or a similar tool, which speeds up your work in an inhuman way. However, it does not seem to me to be the best alternative for a course for complete beginners.

At least for me, at first I like to consolidate concepts by understanding them from the base (knowing their formula, where each data is taken from, etc...), and he does all these calculations too automatically using Excel, without providing you with any mathematical data. .

At first when you are watching the videos it seems that you understand everything perfectly, and that they are very simple concepts, but later when you have to face the proposed exercises, you realize that in reality you only know a handful of "commands" in Excel, and you don't even have enough criteria to know in what order to apply them or where to write each piece of information in the statement.

Finding or deducing each of those mathematical formulas corresponding to the Excel "commands" has not been easy at all, and I want to take advantage of this post to leave all of them written down here, in case you need them (me or anyone else). in the future.

Brief explanation and formula of each concept in Basic Finance

On the other hand, I also received a good shock of reality when I saw that finances do not have as much to do with mathematics as I thought. While mathematics, in some way, serves to interpret and shape numerical data, finance serves to interpret and shape human scenarios, through numerical data.; and this makes a big difference.

Essential Legend for this Finance post:

Since the formulas shown below were little by little written down and deduced by me throughout the course, I do not know what letters are used in a standardized way to refer to each concept, so I leave here a mini-guide on what it means. each letter in the following formulas:

i – interest

It is the percentage that you pay or acquire during each period. It is essential to bear in mind that as a general rule interest is presented annually (also called APR) while the payments or income usually have a monthly frequency.

In this way, every time the letter appears Yo, I will be referring to the INTEREST PER PERIOD (i.e. APR/12 if payments are monthly) and always expressed over 1.

If they tell you that the interest is 6%, they are probably referring to the APR, the interest per month will then be 6/12 = 0.5% and our variable Yo It will be worth 0.005, since it is expressed over 1. This is essential although it may not seem like it now.

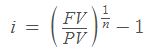

Its formula is the following: (just below we will see what FV and PV are)

n – periods

with the letter n I refer to the number of stipulated periods.

If payments are monthly for a total of three years, n = 12 * 3 = 36.

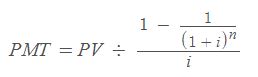

Current value (PV)

Utility 1: Know the initial contribution to reach a final figure

The first concept learned in this course, and one of the most basic terms used. It is the value of a current deposit.

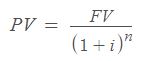

To calculate the current value of a deposit knowing only future data (its value in the future, interest rate and elapsed periods) the following formula is used:

Ex: You need to know how much money to leave in the bank for 5 years at 6% interest so that your savings amount to €20,000.

In this case (n = 60), and (i = 0.5% = 0.005), so you will need an initial capital of €14,827.44.

As you can see, calculating the PV is used to know the initial money you will need if you want to reach a specific amount of money after n years with an interest i.

Utility 2: Calculate the outstanding debt when you always pay the same amount per period

PV can also be used to calculate the outstanding debt in the middle of a payment process, knowing in advance the payment per period and the remaining periods. This process makes a lot of sense, since you are calculating the sum of money that a periodic PMT contribution amounts to with an interest Yo during n periods.

For example: you have to pay $400 every month, for the next 15 months, because then you know that your PV will be equal to the exact number that manages to leave the FV to zero taking into account the payments of each installment and the interest that will decrease as it becomes less money in the account.

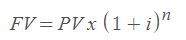

Future Value (F.V.)

It is the value that a deposit will have that grows (or decreases) with a constant interest during a determined period of time.

What is interest (APR)?

The annual interest is the agreed percentage that is paid or deposited each year.

In many cases the payments are made monthly and the interest is cumulative (that is: you deposit a percentage of your current money, and this small extra sum that you deposit will then affect the next payment with interest, so you will receive a little more than the time passed, etc…). This is called compound interest.

When calculating payments by periods (or amortizations) it is then very important to keep in mind that this compound interest will be deducted in this way after each payment.

In the end, an annual interest is agreed with the clause that it is always applied to the total amount of money accumulated. For this reason, the more of your debt you have paid, the less interest you will have to pay on the next one. On the other hand, the more payment periods you make, the greater the accumulated interest that will be paid at the end.

Keep in mind that in a normal amortization you are always paying a percentage of what is outstanding, so it is better to pay a lot in a few installments than to pay a little in many installments.

Example:

Imagine that you have a debt of $1000 and you need to repay it with an interest of 2% per year.

First of all, keep in mind that there is NO fixed amount to return if you do not know in advance the number of installments that you are going to use for it.

You might think that you will simply have to return $1000 + a 20% of 1000. In total $1020. But this is not so.

Esto solo significa que trascurrido un año habrás tenido que abonar el 2% de lo que te quede pendiente de deuda. De esta forma si a final de año decides pagar $220 ($200 de la deuda real + $20 porque es el 2% de %1000), te seguirá quedando una deuda real de $800. Por lo que si al próximo año pagas otros $200, tendrás que abonar $16 extra porque son el 2% de lo que te faltaba por pagar. Y esta operación puede extenderse hasta el infinito si cuantos más pagos hagas.

Continuing with this simple example, if every year you pay $200 of the real debt and it takes a total of 5 installments to pay off your debt, you will have paid interest in the amount of $60 ($20 + $16 + $12 +$8 + $4), which are exactly the 2% of what you had to pay each year.

In the real world this does not happen like this, and payments are usually made per month. In this way, each month you usually pay one-twelfth of the interest agreed annually, since the agreed interest will be distributed equally between each of the twelve months. You will always pay the same percentage each month, regardless of what you still have to pay.

In this way, it is more dangerous to have a debt that extends for too many years than a debt with a high annual interest if it is paid in a few installments.

Annual Effective Interest / Effective Annual Rate (EAR / APR)

This EAR interest (or APR in Spanish) much better reflects the real cost of interest that you will have to request a loan.

It is usually provided by the person who stipulates the interest percentage and it already includes some extra management, maintenance, etc. expenses.

Real Interest (RI) to pay in the amortization of a loan

It is the real interest that you end up paying during a certain number of installments over the course of a year.

Since the initial interest is agreed upon annually, but is usually paid monthly, it is almost impossible for this percentage that the bank (or any other intermediary) gives you to be the true interest that you will end up paying. This genuine interest will almost always be much higher than that agreed annually.

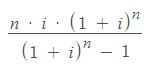

Its formula (not easy to understand) is the following:

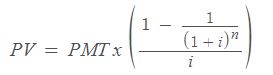

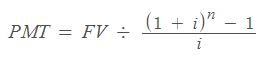

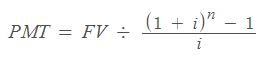

Payment per Period (PMT)

PMT is used to know in advance the fixed amount of money that will be paid in each period, knowing in advance the number of time that will elapse and the interest percentage.

It is important to be aware that interest usually comes as an annual percentage, while payments are made monthly. For this reason, in most cases it is convenient to use the number of periods as n (total months), and the interest as i/12 (annual interest divided by twelve).

How much does a payment for several annual periods cost with inflation? r?

Calculate invested value at interest Yo facing inflation r

Another recurring calculation in finance is knowing how much your invested savings will be worth at an interest rate. Yo facing inflation r; However, there is no direct formula to do this.

It's as simple as calculating each one separately and adding them together. As far as I have been able to investigate, there is NO formula per se since there is no mathematical simplification that allows you to add several equal bases with different exponents.

You will have to calculate the capital increase due to interest each period, and then remove the loss due to inflation.

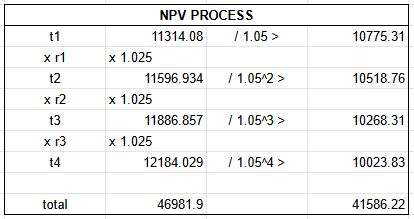

In the example below (taken from the finance course) we want to calculate the value of our $11314.08 invested with an interest of 2.5% against an inflation of 5%.

Another much faster way to do this is using Excel.

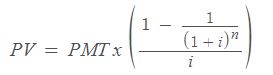

Amortization

Within period payments (PMT), there is a debt amortization, in which despite paying the same thing every month, you do not pay debt and interest equally, but at the beginning you pay little debt and a lot of interest, and In the end you end up paying a lot of debt and little interest.

The idea is that by increasing the debt payment over time and reducing the interest payment, the payment per period always ends up being the same. Hence it can be calculated through this formula.

However, make no mistake: although the monthly payment is always the same, this progressive way of paying debt and interest means that it always ends up being more expensive than it should.

Why don't you pay everything equally each month? D:

Perhaps this is because when you renegotiate the interest, it is applied to what you have left to pay on the real debt. Since at the beginning you pay more for the interest than for the debt, the renegotiation will always be done at a higher value than if you paid the same amount for interest as for the debt every month. In this way, the lender is the one who wins in all scenarios.